UK government debt is running at £400 billion a year or 20% of GDP. Money supply growth is rising by nearly 14% per annum and the ratio of outstanding debt GDP – 85% of the economy just last year – is set to be around 108% of GDP in the 2020/2021 financial year.

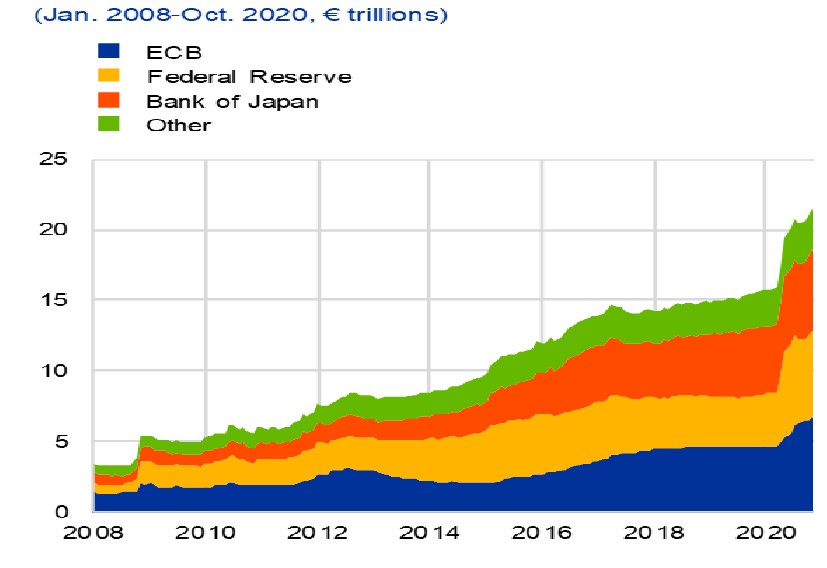

Surely that’s a recipe for rapid inflation at some point in the next few years? The government will need it to reduce the real burden of debt, and monetary policy authorities will lose control and tighten too late. Fast money supply growth and debt monetisation in the form of QE, have in the past been harbingers of price inflation as debt is monetised. Those factors are in place now. UK money supply growth is about 15% a year (from 3% in 2019), and its QE programme is now £875bn, almost 50% of GDP.

Although rampant price inflation, therefore, remains a real possibility, it’s unlikely to happen in the next decade. Why?

- Economic growth has been anaemic by historical standards since the crisis of 2008/9. Growth in the advanced economies was subpar before the pandemic struck in March. Global growth which averaged almost 4% in the decade to 2008/9, has been closer to 3% in the decade since. This has meant spare capacity in the world economy for about a decade and is one of the reasons why inflation has been well below its average of the preceding thirty years.

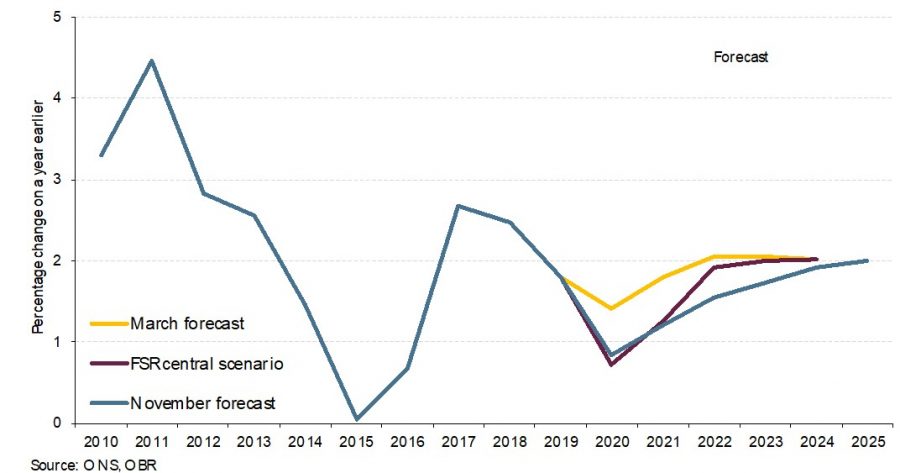

Of course, the pandemic’s effect of reducing global GDP growth by about 5% has had a significant impact on price inflation, creating a large negative global output gap, which will bear down on inflation until it is closed. The best estimate of when that will be is about six years.

You can see this of course in high levels of unemployment and large falls in output. For the UK, the best estimate is that average unemployment will peak next year, with the UK output gap not expected to be closed until 2024 at the earliest. That assumes a free trade agreement with the EU and will keep downward pressure on UK price inflation well into the next five years, as shown by the chart below.

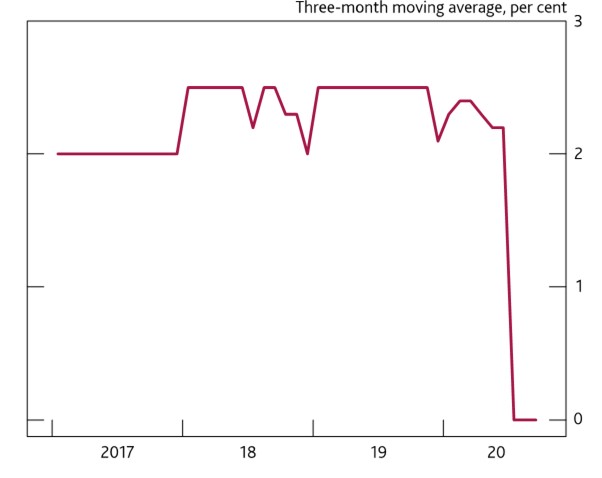

- Wage inflation will remain tame, given higher unemployment. Since it is a significant determinant of price inflation, it is doubtful that prices will rise when pay growth is so low and likely to remain. The chart below shows that pay settlements in the UK are virtually zero and that wage inflation both in nominal and real terms is unlikely.

- The China effect – we could add India and other fast-growing large economies – but it is the best proxy. It now accounts for about 30% of global manufacturing, from under 5% 30 years ago and is integral to the worldwide supply chain. Globalisation has driven down prices across a broad range of goods, from inputs to outputs. In short, substantial global economies of scale have lowered the international price level and reduced upward pressure on price inflation.

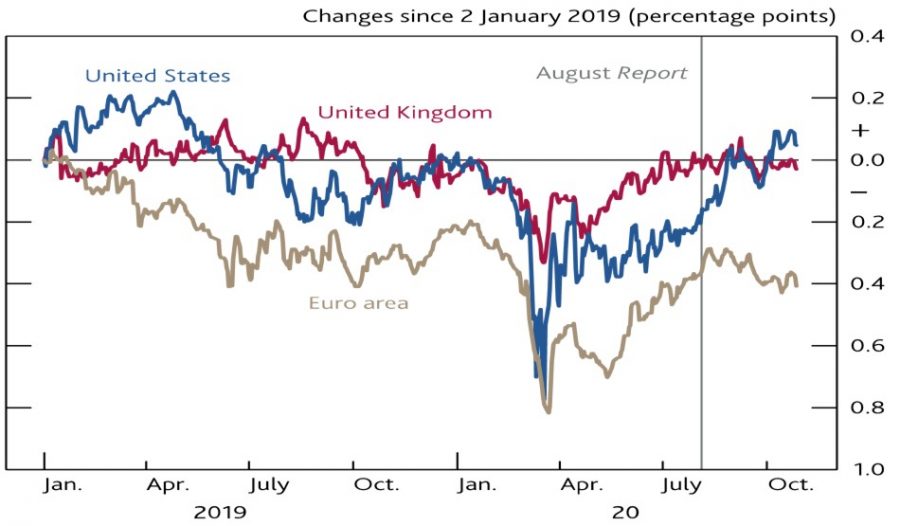

Rumours of its demise are overdone; think about the new silk road that China is building that will end in a town in Bavaria. Far from ending, it is set to persist well into the future as the benefits of lower prices and higher living standards for everyone around the world prove hard to give up. The resultant higher global level of productivity also means lower costs, in turn that ensure lower price inflation. As the next chart shows, global trade uncertainties have dropped back to the sort of levels that persisted before the worldwide health crisis.

- If people and firms do not expect inflation to rise, the actions inherent in views tend to make it less likely that price increases occur. Wage negotiations are likely to settle at lower levels. Firms are less likely to be able to see price increases stick as consumers push back. Currently, financial market expectations which embody these views are well within the range of the last decade.

- Technology, combined with globalisation and often confused with it, has changed everything. While people may not see it immediately, it has been felt in their wallets, lowering the price of consumer goods across a broad range of items over the years. The spread of new technology has revolutionised the productivity of global output. Wider mastering of the process of manufacturing goods at scale has lowered costs and will keep price rises to a minimum.

It’s a pace that is not slackening. From high-end electronics, TVs, smartphones, to low-end fridges and washing machines, the real price of ‘stuff’ has been falling because of smarter ways of making them. One recent example: billions of face masks were made in months of needing them, and now they are cheap and ubiquitous. Think digitisation: it is spreading across all industries and sectors and is still, remarkably, in its infancy.

It will significantly impact financial services in years to come, as well as biotech (note how new techniques helped speed up the search for a vaccine), and the manufacturing, and construction industry to name just a few. Its effects will be lower costs and better, lower pricing of and for a broader range of goods and services.

- The world’s population is ageing. Peak population growth is anticipated at the global level by 2100 – before slowly starting to drop off. In this central scenario by the UN, some areas will expand rapidly like Africa, but some will shrink like Europe and Japan. Rapidly developing economies, like China, will join the latter, and population growth will go into reverse within the next 30 years. Price inflation seems unlikely in such a world of slower economic growth, stemming from more countries with weaker labour force increases and higher saving.

It means weaker growth, of demand and output, so lower pressure on prices. Indeed, deflation becomes a problem. Just look at Japan. It has been trying to reverse deflation for twenty years or so but has not succeeded. Although debt has spiralled to over 200% of GDP, its inflation rate remains in negative territory.

Even without this, around 700 years of data illustrates that deflation is more common than price inflation. Periodic bouts of innovation seem to drive down prices for extended periods.

- Finally, we could be generous to policymakers and argue that they are more attuned to shepherding the economy away from inflation episodes and more likely to react appropriately to signs of persistent inflation than not, learning the lessons of history.

Low inflation means that interest rates will also remain low. Moreover, it is likely that nominal interest rates will remain below price inflation, elongating the period of negative interest rates. But we should not be surprised by this. It typically does happen after global pandemics. And it could last for some time.