Imbalances in the financial sector or the real economy – the usual trigger for recessions – have been markedly absent from the current global economic downturn. Instead, the cause this time was a government-mandated shutdown of the economy owing to a global health crisis. The end of shutdown will see economic growth resume (as indeed it is beginning to), although the long-lasting effects of the pandemic are likely to impact on the level and rate of growth, and take some time to return to pre-crisis states.

But if we consider the way stock markets are rebounding, one would be forgiven for thinking that an effective vaccine for Covid-19 had already been produced, that the real economy was strongly recovering, and that the pandemic was behind us.

Reality check

In reality, the economic news has been pretty bleak. UK GDP dropped by 22% in the first half of the year (H1). Economic growth in the USA fell by over 10% in the same period. In the group of seven industrialised countries (G7), the average fall in GDP in H1 was around 12%. Economic forecasts for global economic output by the IMF (International Monetary Fund) saw a turnaround of 8.2 percentage points from an expected rise of 3.3% in December 2019 to a fall of 4.9% in June 2020, as we can see in chart a.

Yet stock markets in many countries have rebounded by 50% or more from the lows seen in March 2020, as chart b shows. In some cases, such as the US, they are above the level reached when the economy looked as if it was recovery healthily. So, what is going on? Partly, it is that the current economic situation has not been as bad as was feared in March 2020 – weak though it has been. Undoubtedly, there are signs of growth and recovery.

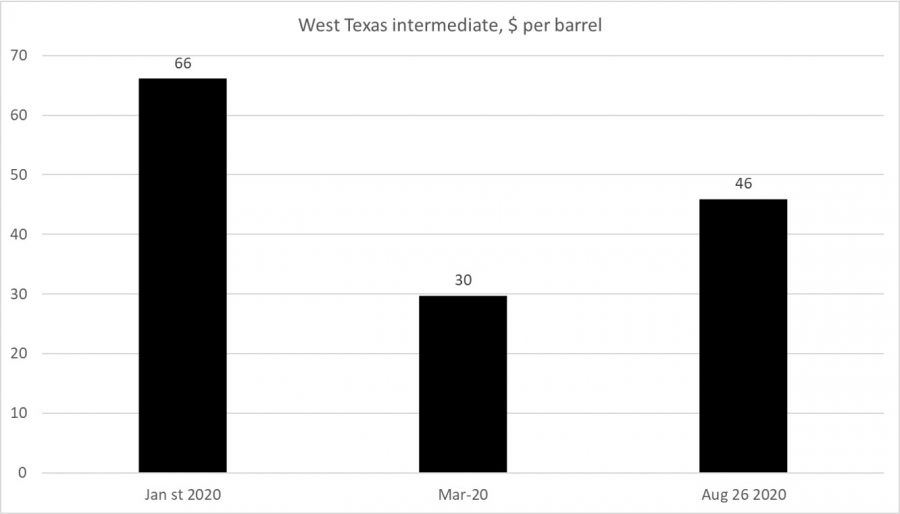

But this view is not represented in all financial data. Caution in economic recovery can be seen in charts c and d. Chart c shows that oil prices are still around $46 a barrel, or 30%, below the pre-pandemic level, and certainly don’t suggest strengthening economic growth. Whilst chart d, on the other hand, shows a 35% rise in gold prices, to just under £2,000 an ounce, that too suggests caution about an economic recovery and implies heightened risk and volatility spiced with potential for a dollar fall.

Markets and economies diverge

The reason that capital markets are riding high even though the world economy remains deep in a recession, is largely because central bank purchases of government debt are financing a massive expansion in fiscal policy. Government bond yields were already very low or in negative territory before the pandemic in many countries and therefore the considerable increase in liquidity that’s occurred since then means that the relative return from holding government assets has fallen compared to returns from investments held by the private sector. As government bond yields are likely to drop back further into negative territory given the current bond buying programmes, the relatively higher returns from holding equities will make them attractive. Therefore, equity prices could rise even further in this scenario as they offer high returns and are therefore more attractive than holding fixed income.

As a result, financial markets in the advanced economies are becoming unmoored from the real economy, rising even as economic growth remains in the doldrums. So, capital markets need to be wary as the economic reality confronts market dynamics. Owing to weaker growth, there will be an increase in corporate failures and bankruptcies later this year. Corporate and household balance sheets will hence have more debt or gearing, leading them to be more reluctant to invest and consume. Unemployment will therefore rise and stay higher for longer than in recoveries seen in the last 30 years. One conclusion from all this is that increased volatility will feature across markets. However, since policymakers will continue to support capital markets, the dive further into unknown territory for investors will continue.

The conclusion? Watch out when QE ends and be prepared for instability and potential shocks whenever the policy stance is reversed, as it surely will at some point.